October 24, 2024

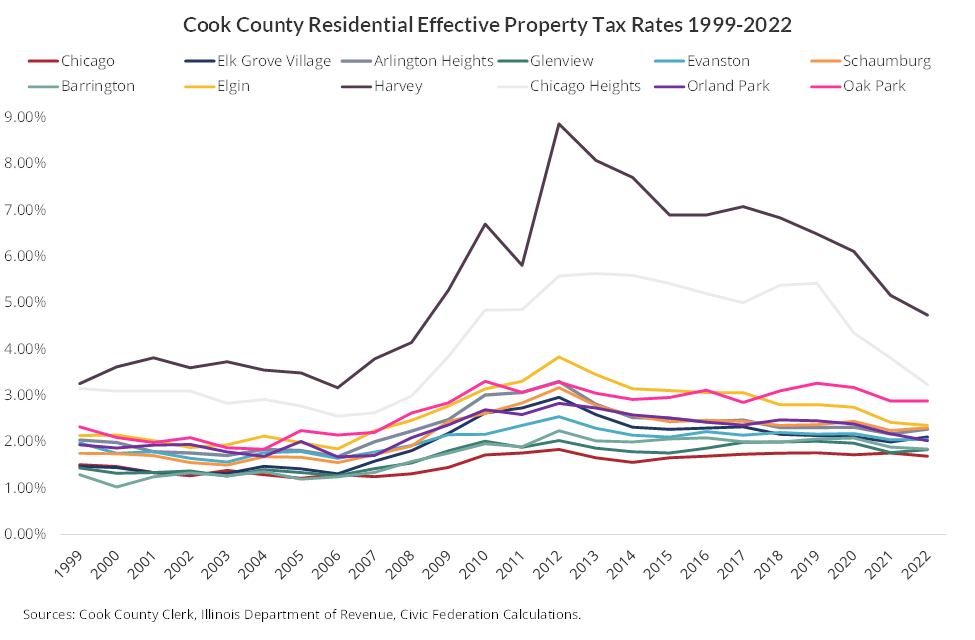

The Civic Federation released our latest report on effective property tax rates in selected communities in Northeast Illinois earlier this month. The report looks at ten years of data from 2013-2022, the most recent year for which data are available. That period encompasses the aftermath of the Great Recession of 2007-2009 and subsequent growth in property values. Generally, effective residential property tax rates have declined across the board in the 12 Cook County communities studied in the report. The last 10 years do not tell the full story, however, so the Federation has compiled effective tax rates on residential properties in Cook County starting in 1999 through 2022, which is shown in the chart below.

An effective property tax rate is a measure of property tax burden for homeowners and businesses. They translate the tax rates on property tax bills into rates that reflect the percentage of full market value that a property owed in taxes for a given year and allow comparisons across communities that have different tax rates and tax bases.

The longer time period shows that the recent decline in residential effective property tax rates across Cook County is essentially a return to closer spreads in these rates across the county that existed before the Great Recession.

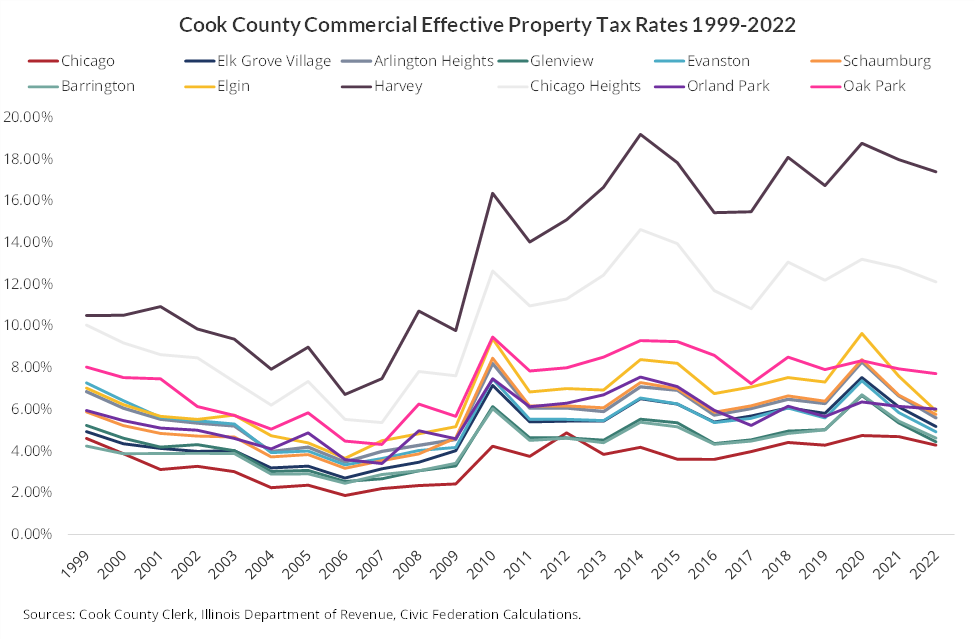

Commercial effective property tax rates in selected Cook County communities have also mostly declined since 2013, but looking at the longer 1999-2022 perspective shows that they have not declined as much as residential rates. Many rates had remained essentially flat before starting to decline after the dislocations of the pandemic in 2020. The following chart compares commercial effective property tax rates across the same 12 Cook County communities.

Chicago over the full 1999-2022 period had the lowest or nearly the lowest Cook County effective tax rates for both residential and commercial properties. A lack of assessment-sales ratio data for industrial properties in Chicago and south Cook County municipalities in many years means it is not possible to generate an effective tax rate chart for that class of property.

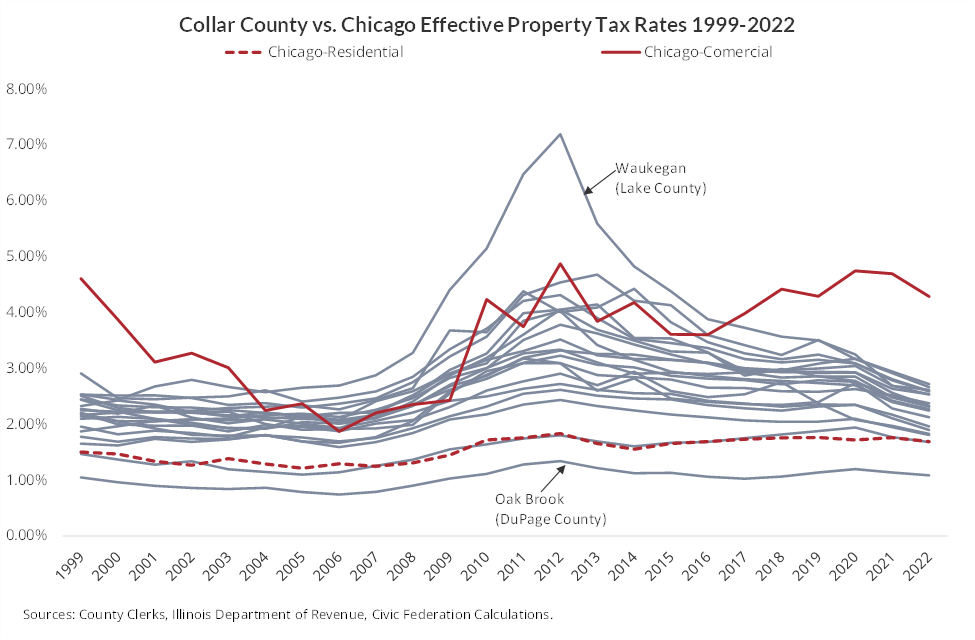

To see how competitive Chicago’s property tax burden is to the rest of the region, it is important to emphasize that all other counties besides Cook do not use differential assessment, so their effective tax rates apply to all taxable properties.1 The following chart shows the 19 communities in the Collar Counties for which the Civic Federation calculates effective tax rates. Of those 19, three are located in two counties: Elgin overlaps Cook and Kane counties, Elk Grove Village overlaps Cook and DuPage counties and Naperville overlaps DuPage and Will counties. Because there are so many municipalities represented in the chart, all of the Collar County data is shown in grey and Chicago is in red for contrast. The chart shows that while Chicago’s residential effective property tax rates are low compared to the Collar Counties, its commercial effective rates have remained high in comparison, mainly due to Cook County’s practice of assessing commercial properties at a higher percentage of full market value than residential properties.

For more about how the Civic Federation calculates effective tax rates and detailed information about the individual communities shown in the above chart, read our effective tax rates report.

References

[1] See Civic Federation, The Cook County Property Assessment Process: A Primer on Assessment, Classification, Equalization and Property Tax Exemptions, April 5, 2010.